U.S. ITIN (IRS) for Non Residents

Trusted by international clients worldwide. We handle your ITIN application with expert care, guaranteed results, and personalized support throughout the entire process.

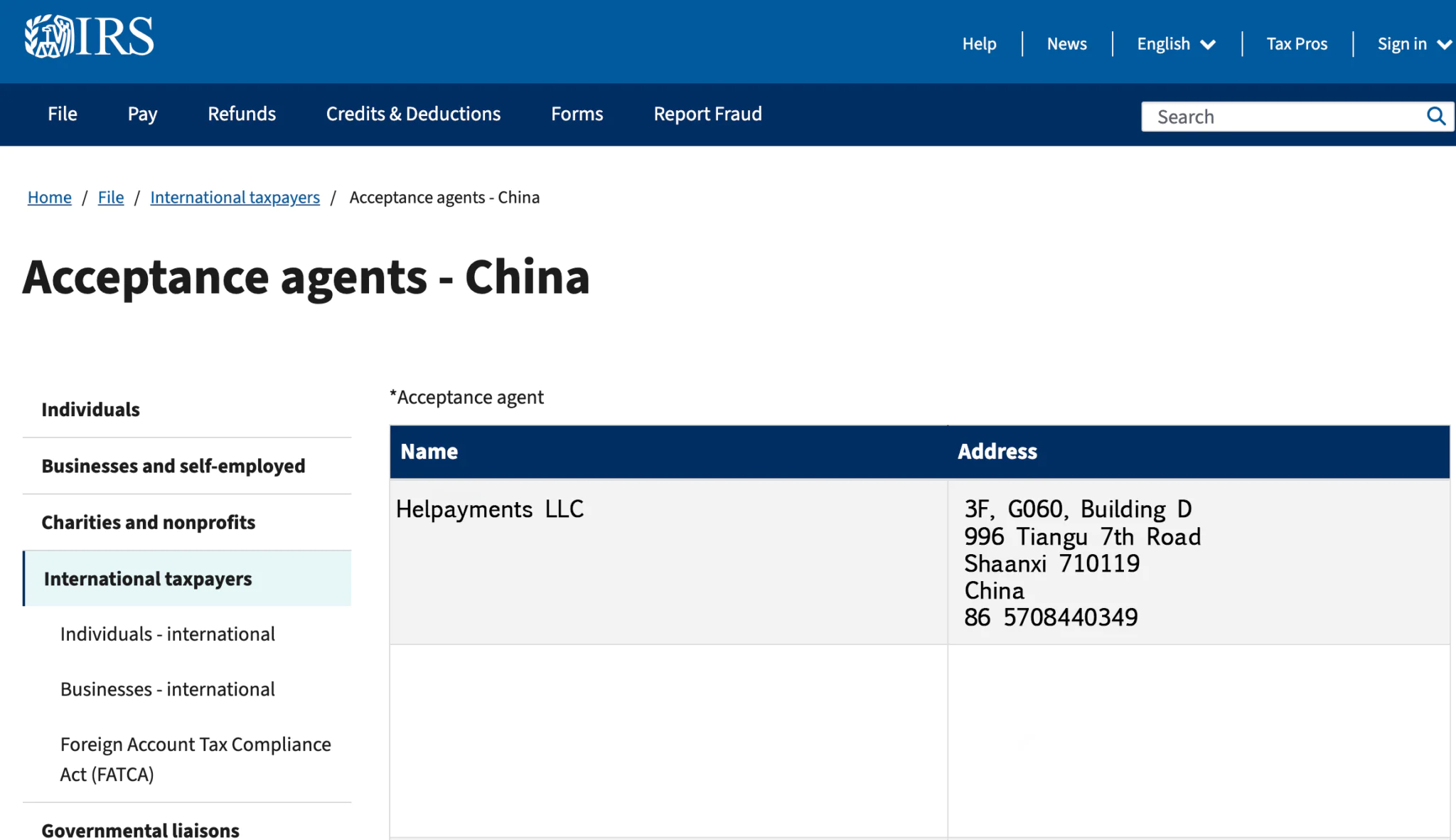

Verified by the IRS, Proven by Results

We are not just an officially listed IRS CAA. We have a proven track record of successfully securing ITIN approval notices for clients just like you.

Official IRS Authorization

We are publicly listed on the official IRS.gov directory. This is your proof that we are an authorized Certified Acceptance Agent (CAA).

View IRS CAA Certification

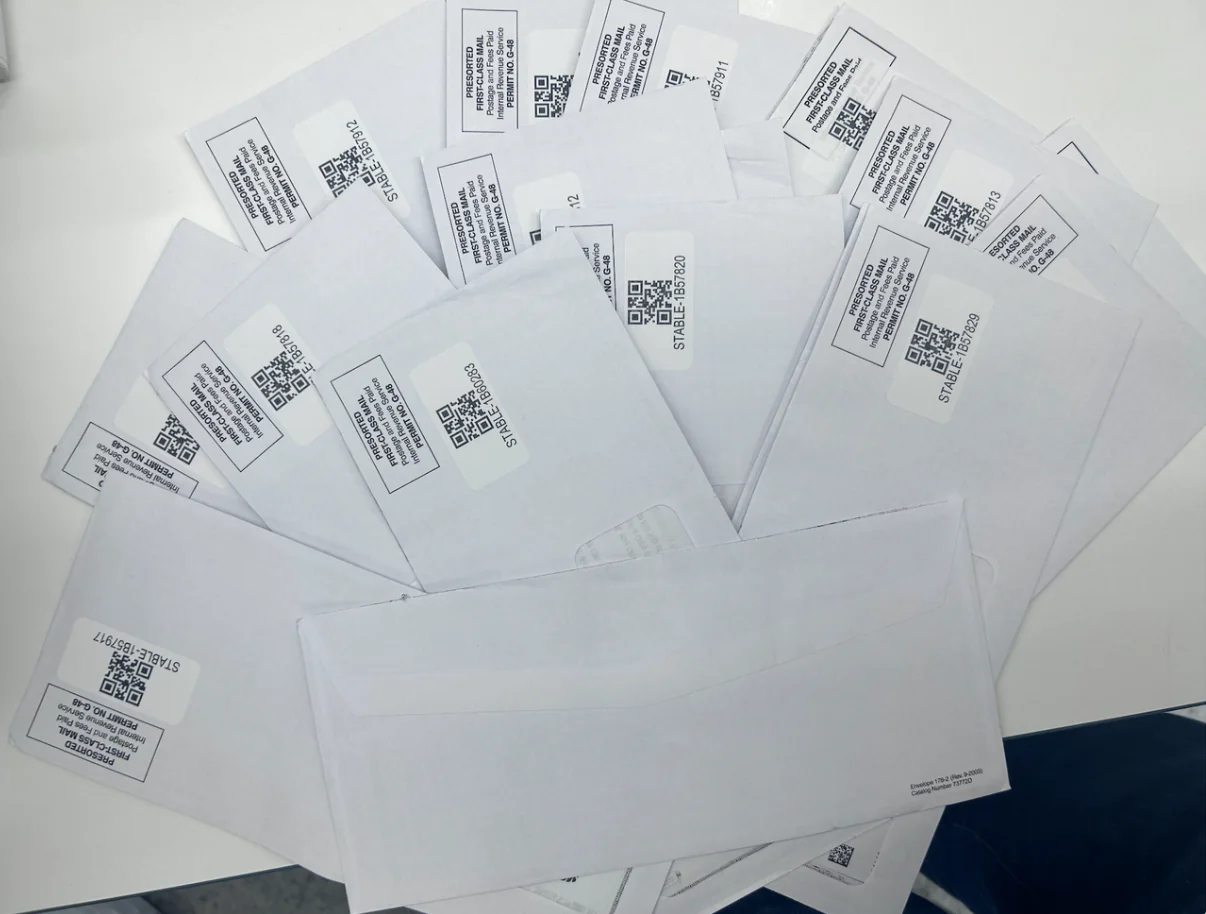

Proven Client Results

These are just some of the many official ITIN approval notices (Form CP565) we've successfully secured for our global clients.

Flexible pricing Built to fit your needs

Choose from tailored plans that fits your needs and timeline.

Standard ITIN

For non-residents needing an ITIN with standard, secure processing

- CAA Passport Verification (No mailing required)

- Complete W-7 Application Preparation

- Submission within 5-7 business days

- No Hidden Fees

- U.S. Mailing Address Included

Priority ITIN

The fastest, all-inclusive option for those who need their ITIN quickly and with full support

- Everything in Standard

- Fast-track prep (4 business days)

- 100% Money-Back Guarantee

- Priority handling & support

- Step-by-step updates

Get Your ITIN Without Mailing Your Passport

As an IRS-Certified Acceptance Agent (CAA), we handle the entire process — securely, accurately, and in full compliance with IRS requirements.

Pay & Submit Info

Application Preparation

Review & Mail

Receive Your ITIN

Discover what our clients are saying

We are proud to serve a global clientele. See how our ITIN services have helped entrepreneurs, investors, and professionals from around the world.

I was worried about sending my passport overseas, but as a CAA they verified everything locally. Got my ITIN in 10 weeks — exactly as promised. Their communication throughout the process was exceptional.

The whole process was seamless. They prepared my W-7, reviewed all documents, and handled the IRS submission. I didn't have to figure out anything on my own. Highly recommended!

As a freelancer working with U.S. clients, I needed an ITIN urgently. The Priority service was worth every penny — fast, professional, and stress-free.

After being rejected twice on my own, I turned to their team. They identified the issues immediately, resubmitted correctly, and I finally received my ITIN. Couldn't be happier!

I was worried about sending my passport overseas, but as a CAA they verified everything locally. Got my ITIN in 10 weeks — exactly as promised. Their communication throughout the process was exceptional.

The whole process was seamless. They prepared my W-7, reviewed all documents, and handled the IRS submission. I didn't have to figure out anything on my own. Highly recommended!

Frequently asked questions

Everything you need to know about the ITIN process. If you're new here, this guide is for you.

An Individual Taxpayer Identification Number (ITIN) is a tax processing number issued by the IRS for individuals who are required to have a U.S. taxpayer identification number but are not eligible for a Social Security Number (SSN). Non-resident aliens, their spouses, and dependents who cannot get an SSN need an ITIN to file taxes.

No! As an IRS-authorized Certifying Acceptance Agent (CAA), we can verify your passport and identity documents directly. You never need to mail your original passport to the IRS, eliminating the risk and hassle of sending important documents through the mail.

The IRS typically processes ITIN applications within 8-12 weeks. With our Priority service, we prepare and submit your application within 4 business days. We track your application status and keep you updated throughout the entire process.

We offer a 100% money-back guarantee on our Priority plan. If your ITIN application is rejected by the IRS for any reason related to our preparation, you will receive a full refund. We stand behind the quality of our service.

Product resources

Stripe solutions for your business challenges.